The 5-Second Trick For Feie Calculator

Table of ContentsHow Feie Calculator can Save You Time, Stress, and Money.Not known Incorrect Statements About Feie Calculator Some Known Details About Feie Calculator Get This Report on Feie CalculatorThe Only Guide to Feie CalculatorThe Best Guide To Feie CalculatorAbout Feie Calculator

If he 'd regularly taken a trip, he would instead complete Component III, detailing the 12-month period he satisfied the Physical Presence Examination and his travel history - Physical Presence Test for FEIE. Step 3: Coverage Foreign Revenue (Component IV): Mark gained 4,500 each month (54,000 each year). He enters this under "Foreign Earned Earnings." If his employer-provided real estate, its worth is likewise consisted of.Mark calculates the currency exchange rate (e.g., 1 EUR = 1.10 USD) and converts his salary (54,000 1.10 = $59,400). Considering that he stayed in Germany all year, the percent of time he lived abroad during the tax is 100% and he goes into $59,400 as his FEIE. Mark reports overall incomes on his Kind 1040 and goes into the FEIE as an adverse amount on Set up 1, Line 8d, minimizing his taxed earnings.

Selecting the FEIE when it's not the finest choice: The FEIE may not be perfect if you have a high unearned revenue, make even more than the exclusion restriction, or reside in a high-tax country where the Foreign Tax Obligation Credit Score (FTC) may be much more advantageous. The Foreign Tax Obligation Credit Score (FTC) is a tax reduction method often utilized together with the FEIE.

The 7-Minute Rule for Feie Calculator

expats to counter their united state tax debt with foreign revenue taxes paid on a dollar-for-dollar reduction basis. This means that in high-tax countries, the FTC can often get rid of united state tax obligation financial debt totally. The FTC has constraints on qualified taxes and the optimum claim quantity: Qualified tax obligations: Only income tax obligations (or tax obligations in lieu of income tax obligations) paid to foreign governments are qualified (Form 2555).

tax obligation on your foreign earnings. If the international tax obligations you paid exceed this limit, the excess foreign tax can normally be continued for up to 10 years or returned one year (using a changed return). Maintaining exact records of international earnings and taxes paid is for that reason crucial to calculating the proper FTC and preserving tax obligation conformity.

migrants to lower their tax obligation liabilities. If a United state taxpayer has $250,000 in foreign-earned income, they can leave out up to $130,000 making use of the FEIE (2025 ). The remaining $120,000 might then be subject to tax, but the united state taxpayer can potentially apply the Foreign Tax obligation Credit rating to counter the tax obligations paid to the international country.

Little Known Questions About Feie Calculator.

First, he offered his U.S. home to establish his intent to live abroad completely and requested a Mexican residency visa with his partner to help fulfill the Bona Fide Residency Test. Additionally, Neil protected a long-term home lease in Mexico, with plans to eventually purchase a property. "I currently have a six-month lease on a house in Mexico that I can prolong an additional 6 months, with the objective to get a home down there." Nonetheless, Neil mentions that buying property abroad can be challenging without initial experiencing the location.

"It's something that individuals need to be actually diligent concerning," he states, and recommends deportees to be careful of common blunders, such as overstaying in the United state

Neil is careful to stress to Anxiety tax united state that "I'm not conducting any performing any type of Illinois. The United state is one of the few countries that tax obligations its citizens regardless of where they live, indicating that also if a deportee has no revenue from United state

The Only Guide for Feie Calculator

tax returnTax obligation "The Foreign Tax obligation Credit score allows individuals functioning in high-tax nations like the UK to offset their U.S. tax obligation responsibility by the quantity they have actually currently paid in tax obligations abroad," says Lewis.

The prospect of reduced living prices can be appealing, yet it typically features compromises that aren't immediately evident - https://louisbarnes09.wixsite.com/feie-calculator. Real estate, for instance, can be more cost effective in some countries, but this can mean compromising on infrastructure, safety, or accessibility to reputable energies and services. Affordable residential or commercial properties could be located in locations with irregular web, restricted public transport, or undependable medical care facilitiesfactors that can considerably impact your daily life

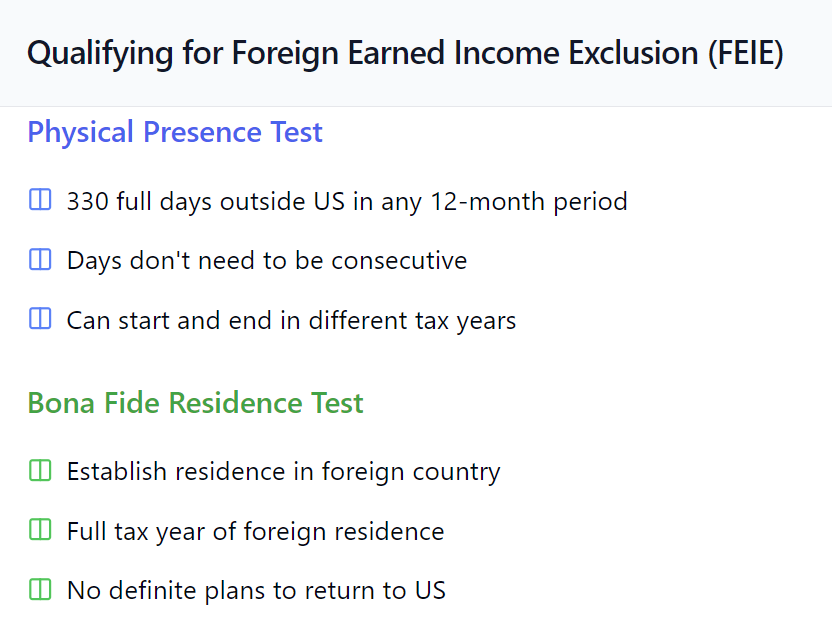

Below are several of one of the most frequently asked inquiries about the FEIE and other exclusions The Foreign Earned Revenue Exemption (FEIE) permits united state taxpayers to leave out approximately $130,000 of foreign-earned revenue from government revenue tax obligation, minimizing their united state tax obligation obligation. To get FEIE, you need to fulfill either the Physical Presence Test (330 days abroad) or the Bona Fide Residence Test (prove your key house in a foreign nation for a whole tax obligation year).

The Physical Visibility Test requires you to be outside the united state for 330 days within a 12-month duration. The Physical Existence Test also needs U.S. taxpayers to have both an international revenue and a foreign tax home. A tax obligation home is specified as your prime area for business or work, despite your family's house. https://myanimelist.net/profile/feiecalcu.

Our Feie Calculator Diaries

A revenue tax treaty between the united state and an additional nation can aid avoid double taxes. While the Foreign Earned Revenue Exemption minimizes taxed revenue, a treaty may supply added advantages for qualified taxpayers abroad. FBAR (Foreign Savings Account Record) is a needed declare U.S. citizens with over $10,000 in foreign economic accounts.

The international gained revenue exclusions, often described as the Sec. 911 exclusions, omit tax obligation on incomes earned from functioning abroad. The exclusions comprise 2 components - a revenue exemption and a real estate exemption. The following FAQs go over the advantage of the exemptions consisting of when both partners are deportees in a basic fashion.

The Best Guide To Feie Calculator

The tax obligation advantage omits the revenue from tax at lower tax obligation rates. Previously, the exemptions "came off the top" lowering earnings topic to tax at the leading tax rates.

These exemptions do not excuse the incomes from US more tips here taxes but merely provide a tax decrease. Keep in mind that a single individual working abroad for all of 2025 who earned about $145,000 without any other revenue will have gross income minimized to absolutely no - efficiently the very same answer as being "tax obligation complimentary." The exclusions are calculated on an everyday basis.

If you attended service conferences or workshops in the United States while living abroad, revenue for those days can not be omitted. Your earnings can be paid in the US or abroad. Your employer's location or the location where wages are paid are not variables in getting approved for the exemptions. Physical Presence Test for FEIE. No. For United States tax obligation it does not matter where you maintain your funds - you are taxable on your around the world revenue as a United States individual.